Over the course of a summer, it’s not unusual for the stock market to be a topic of conversation at barbeques or other social gatherings.

A neighbor or relative might ask about which investments are good at the moment. The lure of getting in at the right time or avoiding the next downturn may tempt even disciplined, long-term investors. The reality of successfully timing markets, however, isn’t as straightforward as it sounds.

OUTGUESSING THE MARKET IS DIFFICULT

Attempting to buy individual stocks or make tactical asset allocation changes at exactly the “right” time presents investors with substantial challenges. First and foremost, markets are fiercely competitive and adept at processing information. During 2018, a daily average of $462.8 billion in equity trading took place around the world.[1] The combined effect of all this buying and selling is that available information, from economic data to investor preferences and so on, is quickly incorporated into market prices. Trying to time the market based on an article from this morning’s newspaper or a segment from financial television? It’s likely that information is already reflected in prices by the time an investor can react to it.

Dimensional recently studied the performance of actively managed mutual funds and found that even professional investors have difficulty beating the market: over the last 20 years, 77% of equity funds and 92% of fixed income funds failed to survive and outperform their benchmarks after costs.[2]

Further complicating matters, for investors to have a shot at successfully timing the market, they must make the call to buy or sell stocks correctly not just once, but twice. Professor Robert Merton, a Nobel laureate, said it well in a recent interview:

“Timing markets is the dream of everybody. Suppose I could verify that I’m a .700 hitter in calling market turns. That’s pretty good; you’d hire me right away. But to be a good market timer, you’ve got to do it twice. What if the chances of me getting it right were independent each time? They’re not. But if they were, that’s 0.7 times 0.7. That’s less than 50-50. So, market timing is horribly difficult to do.”

1. In US dollars. Source: Dimensional, using data from Bloomberg LP. Includes primary and secondary exchange trading volume

globally for equities. ETFs and funds are excluded. Daily averages were computed by calculating the trading volume of each

stock daily as the closing price multiplied by shares traded that day. All such trading volume is summed up and divided by 252 as

an approximate number of annual trading days.

2. Mutual Fund Landscape 2019

TIME AND THE MARKET

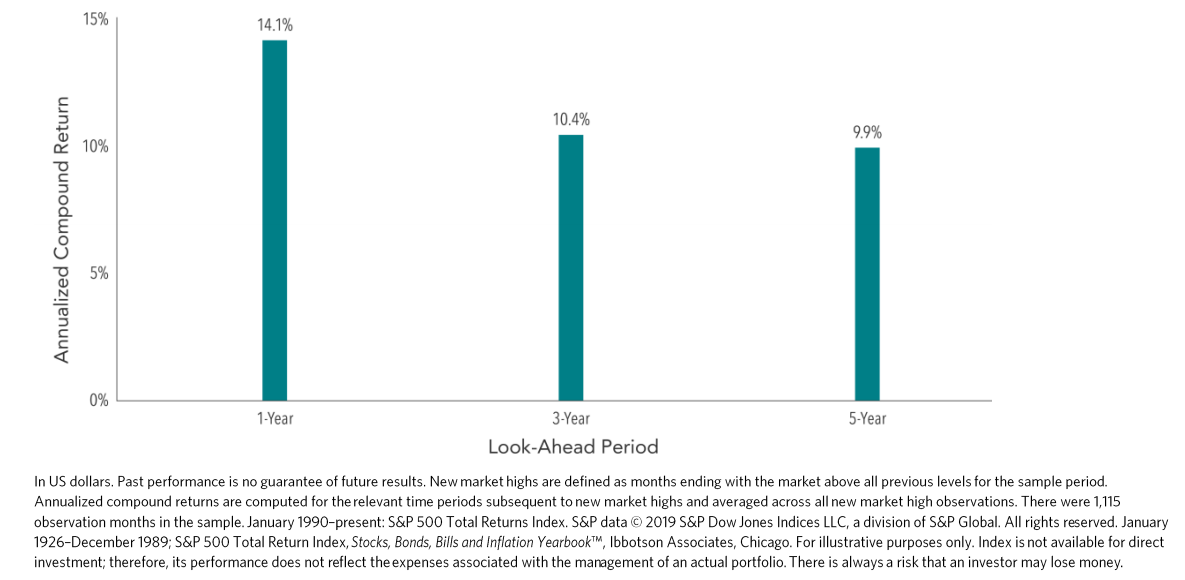

The S&P 500 Index has logged an incredible decade. Should this result impact investors’ allocations to equities? Exhibit 1 suggests that new market highs have not been a harbinger of negative returns to come. The S&P 500 went on to provide positive average annualized returns over one, three, and five years following new market highs.

Exhibit 1. Average Annualized Returns After New Market Highs

S&P 500, January 1926-December 2018

Outguessing markets is more difficult than many investors might think. While favorable timing is theoretically possible, there isn’t much evidence that it can be done reliably, even by professional investors. The positive news is that investors don’t need to be able to time markets to have a good investment experience. Over time, capital markets have rewarded investors who have taken a long-term perspective and remained disciplined in the face of short-term noise. By focusing on the things they can control (like having an appropriate asset allocation, diversification, and managing expenses, turnover, and taxes) investors can better position themselves to make the most of what capital markets have to offer.

Source: Dimensional Fund Advisors LP.

Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of

an actual portfolio.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss.

There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal.

Investors should talk to their financial advisor prior to making any investment decision. There is always the risk that an investor may

lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed

as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Robert Merton provides consulting services to Dimensional Fund Advisors LP.